Alumina Market Trends & Price Outlook 2025 — From Tight Supply to Global Surplus

Banlanchem is a professional Manufacturer, Supplier, and Factory of aluminum hydroxide and alumina materials.

Table of Contents

- 1. Overview of the Alumina Market Trend (2024–2025)

- 2. Alumina Price Trends: 2024–2025

- 3. Global Supply–Demand Balance

- 4. China’s Influence on the Global Alumina Market

- 5. Forecast for 2025: Oversupply Risk

- 6. Bauxite Supply and Raw Material Risks

- 7. Impact on U.S., Europe, and Emerging Markets

- 8. Outlook for 2025–2026

- 9. faq

- 10. Related Products and Internal Links

1. Overview of the Alumina Market Trend (2025)

The alumina market experienced a major shift from early 2024 to early 2025. Tight supply and rising alumina price patterns turned into oversupply and falling margins. This change affected global trade flows, production plans, and price expectations.

Several factors shaped the trend:

- Rapid growth in China’s alumina capacity.

- Limited expansion from overseas refiners.

- Soft demand from aluminum smelters.

- Volatile bauxite prices.

These elements influenced global alumina commodity price levels, alumina index charts, and the aluminium coil price in many regions.

2. Alumina Price Trends: 2024–2025

The alumina price trend showed strong swings. Tight supply pushed prices to record highs in 2024. But by April 2025, prices fell close to cost levels in many regions.

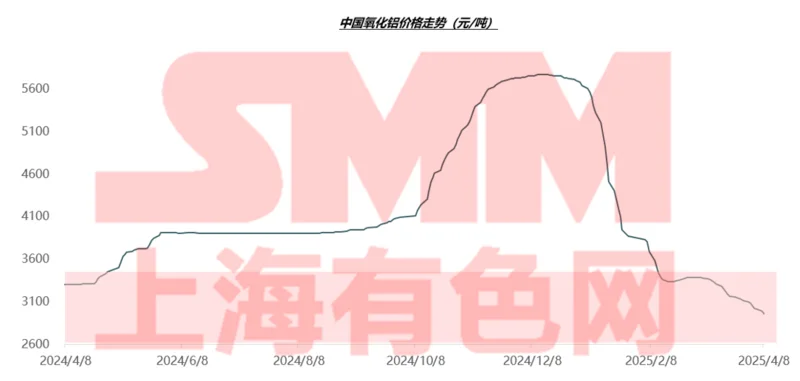

China Alumina Price Trend

- 2024: ¥3,154 → ¥5,769 per ton

- April 2025: ¥2,870 per ton

Australia FOB Alumina Price Trend

- 2024: USD $347 → $810 per ton

- April 2025: USD $330 per ton

The data aligns with global alumina price index charts and alumina market price expectations.

These price movements also influenced:

- metal aluminium prices

- aluminium coil price

- precio de aluminio en USA

- price of aluminum per kilogram

For buyers searching for alumina for sale or where to buy alumina, price volatility became a major challenge.

3. Global Supply–Demand Balance

The alumina market surplus expanded sharply between 2024 and 2025.

- China’s output jumped by **3.88 million tons**.

- Overseas supply increased by only **9,900 tons**.

- Global alumina demand rose by **3.87 million tons**.

- Net global surplus: **1.79 million tons**.

As a result:

- Alumina commodity price moved downward.

- Refining margins tightened.

- Import-dependent markets (U.S., EU) faced lower costs.

4. China’s Influence on the Global Alumina Market

China remained the largest driver shaping alumina price and alumina index price patterns.

- China became a net exporter in 2024.

- Monthly exports reached 370,000 tons.

- Trade flows changed from Australia → U.S./EU to China → Global.

The china aluminium price and alumina price China largely influence global spot markets.

5. Forecast for 2025: Oversupply Risk

The alumina market is expected to stay oversupplied in 2025.

- China to add 13.4 million tons of new capacity.

- Global supply to exceed demand for the second year.

- Prices may stay near cost levels.

Expected Alumina Price Range (2025)

- China: ¥2,600–3,400 per ton

- Australia FOB: USD $250–400 per ton

This affects:

- aluminum per lb in North America

- cost per kg of aluminium in global markets

- are aluminum prices going up? (Short answer: Not likely in the short term)

6. Bauxite Supply and Raw Material Risks

Raw material cost drives the alumina market trend. The price of bauxite impacts refining costs and final alumina market price.

China’s Bauxite Dependence

- Over 80% imported bauxite.

- Guinea remains the top source.

Two Possible Scenarios

- Optimistic: Guinea increases exports → global surplus → lower alumina cost.

- Pessimistic: Slow mining growth → tight supply → alumina price support.

7. Impact on U.S., Europe, and Emerging Markets

The U.S. and Europe face high operating costs and rising import dependence.

- European refineries pressured by energy cost.

- U.S. buyers face higher freight-related cost variation.

- Asia-Pacific supply dominates import markets.

Emerging Market Influence

- Indonesia aims to expand refining capacity.

- Middle East producers target large-scale, low-cost output.

These shifts are key topics in recent alumina news and news aluminium reports.

8. Outlook for 2025–2026

Most indicators suggest a continued surplus in the global alumina market.

Key Expectations

- Weak alumina stock price movement.

- Lower alumina market price globally.

- Potential trade policies (anti-dumping, tariffs).

- More refinery shutdowns in high-cost countries.

- Growing import reliance in U.S. and EU.

- Stable prices for alumina paste, alumina sheet, and specialty grades.

Long-term direction depends on:

- macro demand recovery

- green energy policy

- geopolitical stability in bauxite countries

FAQs: Alumina Market Trends & Price Outlook 2025

1. What factors will influence alumina prices in 2025?

Alumina prices in 2025 will primarily be driven by global supply recovery, bauxite mining stability, energy costs, shipping rates, and production resumptions in China and Australia. Environmental regulations in mining regions will also influence medium-term price volatility.

2. Why did alumina prices fall from 2021–2023 highs?

Prices dropped mainly because of weakened global demand (especially from construction and automotive), lower smelting activity, and large supply additions from Chinese refineries. Increased inventories also placed downward pressure on CIF/FOB prices.

3. What is the expected alumina price range for 2025?

Most industry forecasts place 2025 alumina prices between USD 300–380/ton FOB, depending on regional supply and energy cost. Spot prices may fluctuate more sharply during Q3 consumption peak.

4. Will global alumina supply remain in surplus after 2025?

Yes. New refineries in China, Indonesia, and the Middle East are expected to keep global supply above demand, unless unexpected outages or energy disruptions occur.

5. How do energy prices affect alumina production cost?

Energy accounts for 25–35% of refining costs. Higher natural gas, coal, or electricity prices directly push production costs up, especially for calcined and smelter-grade alumina producers.

6. How will alumina demand change in 2025?

Demand is expected to grow slowly (1.5–2%) led by aluminum smelting, ceramic materials, flame retardants, polishing powder, refractories, and lithium battery separators.

7. Why is China important to global alumina price trends?

China controls over 55% of global refining capacity and has become the main driver of spot price movements, especially for SGA (Smelter Grade Alumina) CIF China imports.

8. What are the biggest risks to alumina price stability in 2025?

Key risks:

- Bauxite supply disruptions (Guinea, Australia, Indonesia)

- Unexpected refinery shutdowns

- Freight cost spikes

- Geopolitical instability

- China’s energy policy tightening

9. What is driving alumina production expansion in Indonesia?

Indonesia is opening multiple alumina plants due to its ban on raw bauxite exports, which encourages domestic refining and downstream aluminum processing.

10. How does alumina inventory affect market pricing?

High inventories in Chinese ports and LME-tracked warehouses put downward pressure on prices. Conversely, refinery outages often cause sharp short-term price spikes.

11. Will alumina prices rebound in the second half of 2025?

A moderate rebound is possible if demand rises with global industrial recovery and if refinery maintenance reduces output. However, long-term upward movement remains limited due to ongoing refinery expansions.

12. What industries influence non-metallurgical alumina price?

Polishing, ceramics, abrasive materials, flame-retardant fillers (ATH), catalyst carriers, lithium battery separators, electronic substrate markets all contribute to seasonal price movements.

13. How does freight cost affect alumina export price?

Since alumina is a bulk commodity, ocean freight can represent 10–18% of total cost. Higher fuel prices or container shortages increase CIF prices significantly.

14. What price difference exists between SGA and calcined alumina?

SGA alumina typically trades lower because it's used for smelting. High-purity, tabular, or calcined alumina grades command higher prices due to stricter impurity control and energy-intensive calcination.

15. How can buyers reduce alumina procurement risk in 2025?

- Diversify sourcing countries

- Secure long-term supply contracts

- Monitor bauxite mining disruptions

- Track freight market trends

- Choose stable, high-quality producers like Banlanchem

10. Related Products and Internal Links

Learn more about alumina and aluminum hydroxide products. Banlanchem is a dependable Manufacturer, Supplier, Factory, and Wholesale exporter.

For business cooperation or alumina for sale inquiries, contact Banlanchem: https://banlanchem.com